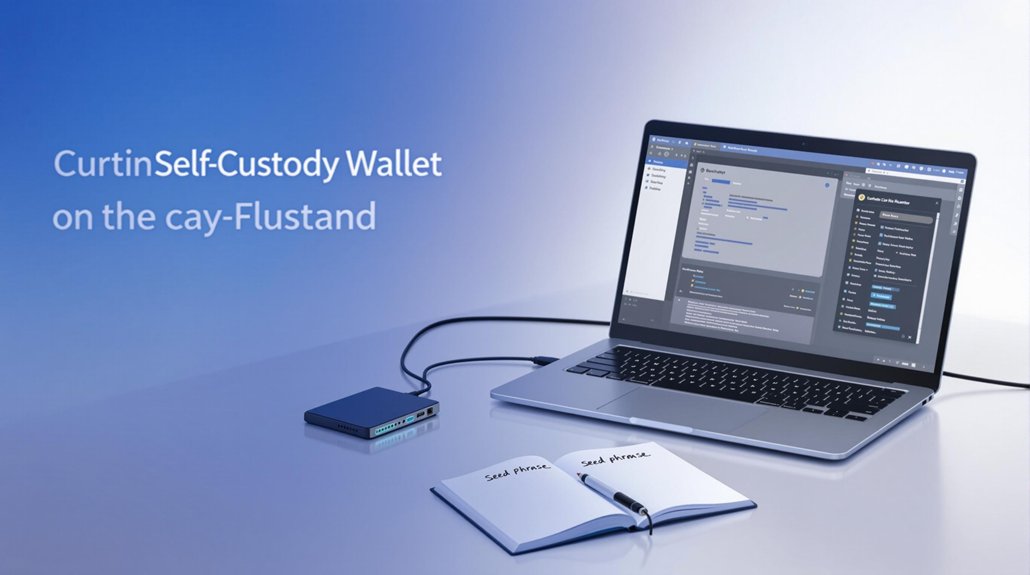

A self-custody wallet lets users manage their cryptocurrency without any middleman or bank. It’s like having a digital safe where only the owner has the password, called a private key. These wallets come in different forms – hardware devices, software apps, or even paper printouts. Users have complete control over their crypto assets but must also take full responsibility for keeping their private keys secure. Understanding self-custody wallets reveals a crucial part of cryptocurrency ownership.

Quick Overview

- A self-custody wallet is a digital tool that gives users complete control over their cryptocurrency through private keys without third-party involvement.

- Users maintain direct responsibility for storing, securing, and managing their private keys, which function like digital passwords for accessing funds.

- Unlike exchange wallets, self-custody wallets operate independently, allowing users to interact directly with blockchain networks for transactions.

- These wallets come in various forms including hardware devices, software applications, paper wallets, and multi-signature solutions for different security needs.

- Self-custody provides enhanced privacy and censorship resistance but requires users to carefully manage their own security and backup procedures.

As cryptocurrency becomes more mainstream, self-custody wallets have emerged as a popular way for people to manage their digital assets. These wallets give users complete control over their private keys, which are like digital passwords that prove ownership of cryptocurrencies. Unlike traditional banking where a company manages your money, self-custody wallets don’t involve any third parties, letting users interact directly with blockchain networks. These solutions emphasize decentralized finance principles by providing users with complete ownership of their assets. Businesses increasingly rely on these wallets for their treasury operations to maintain full control over company funds.

There are several types of self-custody wallets available to cryptocurrency users. Hardware wallets are physical devices that store crypto offline, providing extra security against online threats. Software wallets can be installed on phones, computers, or used through web browsers for easier access. Paper wallets are simply printouts of private keys, while brain wallets rely on memorized passphrases. Multi-signature wallets add another layer of security by requiring multiple keys to approve transactions. This flexibility in wallet types ensures users can find solutions that match their specific compatibility needs.

Self-custody wallets offer important benefits to their users. They provide full control over cryptocurrency assets and transactions, allowing people to manage their funds without depending on banks or other institutions. These wallets also enhance privacy since users don’t need to share personal information with third parties. They’re resistant to censorship, meaning no one can freeze or block access to the funds. Users might also save money on transaction fees since they’re not paying for a company’s services. Unlike custodial solutions, these wallets provide data breach protection since private keys are never stored with third parties.

However, using a self-custody wallet comes with significant responsibilities and challenges. Users must carefully manage their own private keys because if they’re lost, there’s no way to recover the cryptocurrency. Unlike traditional bank accounts, there’s no customer service department to help with forgotten passwords or technical issues. Users need some technical knowledge to use these wallets safely and avoid common mistakes that could lead to lost funds.

The security of a self-custody wallet depends entirely on the user’s ability to protect their private keys. Cryptocurrency owners must be careful to avoid phishing attacks, where scammers try to trick them into revealing their private keys. They also need to create secure backups of their wallet information and store them safely.

While self-custody wallets offer independence from traditional financial systems, they require users to be vigilant and responsible with their digital security. This trade-off between complete control and personal responsibility has made self-custody wallets an important tool in the cryptocurrency ecosystem.

Frequently Asked Questions

How Much Does It Cost to Set up a Self-Custody Wallet?

Setting up a self-custody wallet can be free or cost up to $200.

Popular software wallets like MetaMask and Trust Wallet are free to download and use.

Hardware wallets, which offer extra security, typically cost between $50-$200.

There aren’t usually any monthly fees, but users might face network transaction fees when moving crypto.

Some optional extras, like steel backup plates for recovery phrases, can cost $30-$100.

Can I Recover My Wallet if I Lose My Phone?

Yes, it’s possible to recover a wallet after losing a phone.

The key is having the seed phrase, which is like a special password made up of 12-24 words. This phrase can be used to restore the wallet on any new device.

Without the seed phrase, there’s no way to get the wallet back.

That’s why it’s important to keep the seed phrase stored safely somewhere other than the phone itself.

Which Self-Custody Wallets Are Most Secure for Cryptocurrency Beginners?

Hardware wallets like Ledger Nano X and Trezor Model T are considered the most secure options for beginners.

They store cryptocurrencies offline, away from internet threats. These devices have multiple security layers including PIN codes and recovery phrases.

For software options, Coinbase Wallet and MetaMask are popular choices that offer strong security features like two-factor authentication and biometric locks, though they’re not as secure as hardware wallets.

Are Self-Custody Wallets Legal in All Countries?

Self-custody wallets aren’t legal everywhere.

While most countries like the US, UK, and EU allow them, some nations have strict rules or bans.

China has completely banned crypto transactions, affecting self-custody wallets.

Japan and South Korea permit them but have specific regulations.

Switzerland, Malta, and Singapore are quite welcoming to these wallets.

The rules keep changing as countries work to balance innovation with security concerns.

Can Hackers Steal Crypto From My Self-Custody Wallet?

Yes, hackers can steal crypto from self-custody wallets. They mainly target hot wallets that are connected to the internet.

They’ll use tricks like phishing emails, malware, and fake websites to try to get private keys or seed phrases.

While hardware wallets (cold storage) are safer, they’re not completely hack-proof. Common attacks happen through phone scams, fake apps, and compromised software.

Even careful users can fall victim to sophisticated hacking methods.